Our loan solutions come with expert financial planning to help you manage repayments, optimize your budget, and achieve your financial goals. We provide clear terms and flexible options.

Access flexible credit and loan solutions with transparent terms, tailored to meet your needs and support your growth, with transparent terms and easy access to help you achieve your financial goals.

Our loan solutions come with expert financial planning to help you manage repayments, optimize your budget, and achieve your financial goals. We provide clear terms and flexible options.

Enjoy unparalleled flexibility and convenience with our premium credit line, offering high credit limits, competitive interest rates, and instant access to funds. Tailored for your financial needs, it ensures smooth, stress-free management of your expenses while enhancing your purchasing power.

Get Started

Your personal loan has been approved.

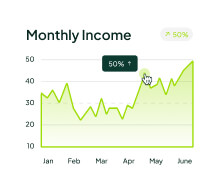

7 days report

Total balance

Create an account by providing basic information, Complete identity verification to ensure a safe & compliant experience.

Once verified, Submit your loan application by providing the necessary details, such as the loan amount, purpose, and personal information.

Our team will review your application, assess your eligibility, Once approved, the loan amount will be disbursed directly to your bank account or chosen payment method, typically within 24–48 hours.

Find quick answers to common queries about our services, if you have more questions kindly contact our 24/7 support service.

Contact UsTypically, we require proof of identity, income, and address. Additional documents may be requested depending on the loan type.

Loan approval usually takes 1-3 business days, depending on the complexity of your application and the verification process.

Yes, you can pay off your loan early without any penalties. This can help reduce interest costs and improve your financial flexibility.

Missing a payment may result in late fees and could negatively impact your credit score. We encourage setting up reminders or contacting us for assistance if you're having trouble.

© Quantum Ledger Bank 2025